Editor’s note: This is the first in an occasional series examining promises made by Paul LePage when he campaigned for governor in 2010.

When he was running for governor, Paul LePage recognized the crisis that could be caused by the $4.3 billion the state owed for the pensions for teachers and state employees.

But he didn’t say precisely what he would do about it.

He did say what he would not do — cut state government “in half” to find the money.

Candidate LePage publicly addressed the pension debt directly, once in a newspaper interview and, later in the campaign in another news interview, but this time through a policy advisor.

Here’s the relevant portion of an interview with candidate LePage by the Sun Journal about the 2028 state constitutional deadline for paying off the then-$4.3 billion pension debt:

“I don’t see how we can get there in 18 years without cutting state government in half. And I do not intend to cut state government in half.”

He said he would try to grandfather employees currently enrolled in the system while designing a new system for new hires.

“Can I promise that there won’t be modifications to the old system? No, I can’t. I would be an absolute idiot to make that kind of commitment.”

The plan he proposed as governor, about one month after taking office, would have reduced the pension debt — known as the unfunded actuarial liability — by more than 80 percent, making it easier and more affordable to meet the 2028 deadline.

The plan that was passed by the legislature and signed by LePage was different than his original proposal, but also cut the debt, by 41 percent.

Did LePage cut state government in half to fund the pension changes? He did not.

The budget passed by the legislature and signed by LePage for 2011-2012 is $6 billion, 0.6 percent less than the previous budget, excluding the one-time federal stimulus grant.

He did not create a system for new hires, so there was no need to “grandfather” current hires. However, the budget bill he signed calls for a plan to be developed to put new hires on a different pension plan in 2015.

He did propose “modifications” to the system that would have affected current employees: a dramatic cutback in cost-of-living increases; an increase in how much state employees contribute to the pension fund from their paychecks; and a decrease in what the state contributes.

Most of that was dropped or altered by the legislature, but it was LePage who got the ball rolling when it came to pension changes.

LePage addressed the issue a second time as a candidate when the Maine Center for Public Interest Reporting asked him for his plan for dealing with the pension debt. He referred that question to one of his campaign advisors, Bruce Poliquin, an unsuccessful candidate for the GOP nomination for governor. Poliquin had been a New York investment manager specializing in pension funds.

Here’s the relevant excerpt from the Oct. 19 story by the Center:

Poliquin, who has been an investment manager, said he and another defeated primary candidate, Sen. Peter Mills, R-Cornville, are working on a plan to solve the problem, but it won’t be completed until after the election.

He said they are awaiting the results of a study of the problem requested of the retirement system by two legislative committees.

He recognizes that the increasing payments to the system will “put pressure on education, welfare, roads, bridges — you name it.”

“Unless we deal with this,” Poliquin said, “Maine will not return to fiscal health.”

The plan was completed and made public in February — so it was “after the election.”

And it is also factual, as Poliquin implies, that they did “deal” with the pension debt and that government financing experts at bond rating agencies consider a reduction in the debt a sign of “fiscal health.”

Did the LePage administration use the study by the Maine Public Employees Retirement System in making its recommendations, as Poliquin said they would?

Yes … and no.

The formal report wasn’t released until after the LePage administration presented its budget, which included the pension changes.

But Sandy Matheson, the executive director of the pension system, said, “We provided data in response to specific questions from the Governor’s budget team. Many of their questions were about the same topics we were covering in the report, so there was quite a bit of overlap. They didn’t have the actual report however prior to the release to the Legislature.”

In an interview with the Center, Gov. LePage said he kept his promises about the pension.

“Our goal was not to lower the pension payments to the retirees,” he said. “I think we did we did that … by freezing the COLA. The pension going forward is devalued a bit over the next three years. We knew that.”

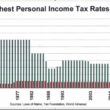

LePage has justified the decrease in the cost of living adjustments as a “sacrifice” from state employees that is balanced by the sacrifices taxpayers have to make to pay for the pension debt based on the “unkept promises and assumptions of the past.”

Chris Quint, the executive director of the Maine State Employees Association, also talks of promises not kept.

State employees and teachers, he said, were “promised something when they retired — and the state has reneged on that promise.”

Bottom line: LePage initiated the pension debt reductions; the legislature’s appropriation committee — Republicans and Democrats — came up with the final plan that LePage signed. The state budget was not decimated in the process, but the price was paid by current and future retirees whose pension will not go up in the future as they had planned.

The governor said he has a plan for mitigating that loss: He said he will ask the 2011 legislature to eliminate income taxes on all retirement income — including state retirees.

“By doing all that,” LePage said, “all the adjustments we made and even the devaluations we made … your cash flow is not going to affected” because retirees will make up what they lost in COLA by lower taxes.